) "Seven zeros, two twos" — The US Fed, which has shown severe divergence on the issue of interest rate cuts, seemed to declare one thing to everyone on Wednesday through a "dry"-shaped dot plot: it remains incapable of taking any action at present...

Undoubtedly, at last night's policy meeting where the US Fed again "stood pat" (keeping the target range for the federal funds rate unchanged at 4.25%-4.5%), the most closely watched aspect by industry insiders was the quarterly release of the Fed's interest rate dot plot.

In the latest dot plot released this month, the 19 Fed policymakers collectively projected a cumulative 50-basis-point interest rate cut by year-end from current levels, which roughly aligns with the median reflected in the March dot plot.

However, upon closer inspection of the details, investors could easily spot a stark change: as we highlighted earlier this month, the Fed has descended into deepening internal divisions.

In fact, despite both dot plots signaling "two rate cuts this year," the underlying messages conveyed significant differences:

The most obvious point is, in the June dot plot, as many as seven Fed officials now support "no rate cuts this year," while the number favoring "two cuts" dropped from nine in March to eight, with two officials each supporting "one cut" and "three cuts."

This "dry"-shaped extreme distribution of dots marks a stark contrast to the relatively balanced spread in March — at least two officials who backed one cut in March and one who supported two cuts have now joined the "no cut" camp.

Arguably, the emergence of these two opposing factions reflects the Fed's current "helplessness" amid uncertainties surrounding tariffs, geopolitical tensions, and inflation.

As we reported earlier this month , some policymakers may argue to treat tariff impacts as "transitory," allowing them to be somewhat "ignored," a stance that would open the door to rate cuts; yet many officials on the rate-setting Federal Open Market Committee believe tariff-driven inflation could become more persistent, making them hesitant to act this year...

Anxiety over potential "stagflation"

Overall, the wording changes in this Fed meeting statement were actually quite limited. The US Fed removed the statement about the unemployment rate remaining stable at low levels in recent months from its latest announcement, but the related wording saw only minor changes, stating that "the unemployment rate remains low." The Fed also revised "further increase in uncertainty regarding the economic outlook" to "uncertainty has declined somewhat but remains elevated."

Although "uncertainty has declined somewhat," the Fed, which now sees things more "clearly," appears to be growing more concerned (though not to an extreme degree) about the economy falling into "stagflation."

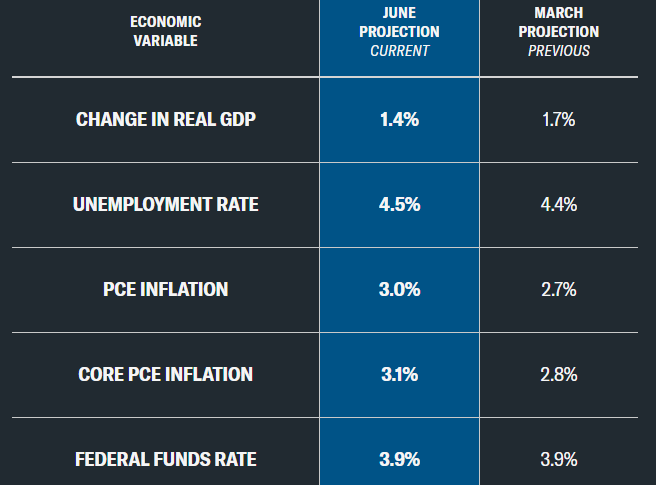

This is reflected quite prominently in the latest quarterly Summary of Economic Projections (SEP): Fed officials lowered their GDP growth forecast for this year while raising their expectations for inflation and the unemployment rate.

The SEP report shows that Fed officials raised their median inflation forecast for the end of 2025 from 2.7% to 3% but lowered their economic growth forecast from 1.7% to 1.4%. The Fed also expects the unemployment rate to rise to 4.5% by year-end, slightly higher than previously projected.

Rising inflationary pressures typically imply that the Fed should curb the economy by raising interest rates, while slowing economic growth and a cooling labor market call for rate cuts to stimulate the economy.

Thus, the "stag" and "flation" reflected in the economic projections may also explain why Fed officials now present extreme divergence in rate expectations—either "no rate cuts this year" or "two rate cuts."

Macro economist Catarina Saraiva noted, "Given current price levels (the April PCE growth rate was 2.1%), a 3% inflation expectation for this year is quite high. This would significantly intensify price pressures again. On the surface, this forecast is hard to reconcile with two rate cuts, but Fed officials clearly believe this is temporary, with inflation pulling back to 2.4% next year and to 2.1% by 2027."

Powell and His Fed Colleagues

As the Fed has split into two extreme "camps," another major question now and in the near future is undoubtedly: Where do Fed Chairman Powell and his Fed colleagues stand?

Powell’s remarks at the overnight press conference largely "hedged," revealing no clear stance.

During the press conference, Powell emphasized the current strength of US economic development and the labor market, stating that current policies are "well positioned" to respond to developments, while trade and fiscal policies "continue to evolve," and the Fed is in no rush to adjust policies.

During the Q&A session, inflation was the first topic discussed. Powell also addressed the issue directly, stating, "We have seen a slight uptick in goods inflation and do expect it to become more pronounced this summer."

He emphasized that it would take time to observe the impact of tariffs throughout the entire goods distribution chain, noting that many products currently sold by retailers were imported months before the tariff hikes. He also said, "We have begun to see some effects and expect to see more in the coming months. We have indeed observed price increases in some related categories, such as personal computers and audio-visual equipment, which can be attributed to the tariff hikes."

Powell indicated that, given the current economic situation, the US Fed "is well-positioned to wait and gain further insight into the potential direction of the economy." He also mentioned that the current monetary policy is in a "moderately restrictive" state, a notable contrast to the description in March when it was "clearly restrictive."

Powell downplayed the shifts in the dot plot. He admitted that currently, "no one is entirely certain about these interest rate paths," but expected to gain more in-depth knowledge about tariffs throughout the summer.

Macro analyst Chris G. Collins commented, "Based on the recent remarks of the US Fed and our comparison of hawkish and dovish viewpoints, we believe that Fed Chairman Powell's stance is more dovish than the average on the committee, but not an extreme position. Therefore, he is likely one of the members who anticipate two interest rate cuts this year."

In fact, industry media have recently compiled an updated distribution chart of the US Fed's hawkish and dovish factions. Although it cannot be directly correlated with the US Fed's dot plot, it may still provide a general idea of which officials currently support "no interest rate cuts" or "two interest rate cuts" within the year...

(Doves on the left, Hawks on the right)

It is not difficult to see from the chart that Powell may generally be in the faction supporting two interest rate cuts. Some of the most hawkish officials—such as Dallas Fed President Lorie Logan, Cleveland Fed President Loretta Mester, and Minneapolis Fed President Neel Kashkari—are likely "hot candidates" for supporting no interest rate cuts this year, a point that investors may also want to pay close attention to in their future speeches and statements.

What does Wall Street think?

Judging from the movements in the financial markets, due to the median forecast of two interest rate cuts this year in the US Fed's dot plot on Wednesday, which aligns with the current interest rate pricing in the market, there was no significant fluctuation in the stock and bond markets last night.

The S&P 500 index on the US stock market closed nearly flat on Wednesday, giving up earlier gains: the S&P 500 index closed down 1.85 points, or 0.03%, at 5,980.87. US Treasury yields narrowed their earlier losses in late trading on Wednesday: the benchmark 10-year US Treasury yield dropped slightly by 0.4 basis points to 4.387% in late trading. The yield on the two-year US Treasury note, which is sensitive to interest rates, fell by 1.5 basis points to 3.935%.

Peter Cardillo, chief market economist at Spartan Capital Securities, said, "Powell has actually made it quite clear that he will not change monetary policy until Fed officials have finalized their assessment of the impact of tariffs on inflation."

Steve Englander, head of G10 FX research at Standard Chartered Bank, pointed out, "The goal of this FOMC meeting was to expand the range of possible policy responses, but no commitments were made."

"They don't seem to be in any hurry to consider an interest rate cut or any form of coordinated action," Andrew Wells, chief investment officer at SanJac Alpha, also noted.

Simon Dangoor, head of fixed income macro strategy at Goldman Sachs Asset Management, said, "Essentially, FOMC members continue to believe that the recent stronger inflationary pressures are likely to be transitory, and they remain relatively intolerant of rising unemployment. We expect the US Fed to keep interest rates unchanged at its next meeting, but if the labour market weakens, we anticipate a possible resumption of the easing cycle later this year."

Judging from the latest pricing in the interest rate market, the US Fed's first interest rate cut could come as early as September, but at its next meeting (at month-end July), the Fed "may still be unable to do anything."

The CME FedWatch Tool shows that currently, interest rate futures traders expect an 89.7% probability that the Fed will keep interest rates unchanged at its next meeting, with only a 10.3% probability of a rate cut. The probability that the Fed will keep interest rates unchanged at its September meeting is 37.2%, with a 62.8% probability of a rate cut.